Introduction

Throughout history, brilliant minds have crafted financial innovations that have fundamentally transformed how we interact with money. These advancements have reshaped economies, fueled trade, and altered the way we save, spend, and invest. From the humble beginnings of coinage to the complex algorithms of cryptocurrency, let’s embark on a journey through the top 15 financial innovations that have left an enduring mark on our world.

Top 15 Financial Innovations – (One Line Descriptions)

- Coinage: Standardized metal currency revolutionized trade and exchange.

- Paper Money: Portable and convenient representation of value.

- Banking: Safekeeping of funds, lending, and facilitating economic growth.

- Stock Exchanges: Organized markets for buying and selling company shares.

- Insurance: Protection against financial risks and unforeseen losses.

- Checks: A convenient and secure payment method instead of carrying cash.

- Credit Cards: Access to revolving credit for purchases and payments.

- Automated Teller Machines (ATMs): 24/7 banking access for cash withdrawals and deposits.

- Electronic Trading: Faster, more efficient financial transactions.

- Online Banking: Remote banking services and financial management.

- Mobile Payments: Seamless transactions using smartphones and apps.

- Peer-to-Peer (P2P) Lending: Connecting borrowers and lenders directly.

- Robo-Advisors: Automated investment advice using algorithms.

- Crowdfunding: Raising capital from a large pool of individuals.

- Cryptocurrency: Decentralized digital currency utilizing blockchain technology.

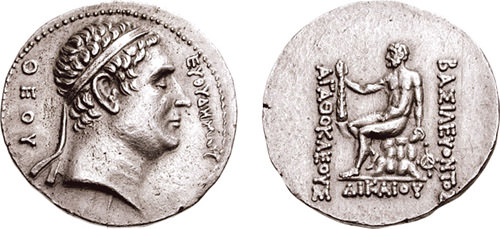

1. Coinage

- History: Before coins, people traded goods directly (bartering), which was cumbersome and inefficient. Around 700-600 BC, the kingdom of Lydia (modern-day Turkey) introduced coins made of precious metals like gold and silver. These coins had official stamps to guarantee their weight and value.

- Impact:

- Universal Exchange: Coins made transactions much simpler. Everyone knew what a coin was worth, ending the need for complex negotiations.

- Easy Storage & Transport: Coins were small and durable compared to bulky goods, ideal for traveling merchants and fueling trade.

- Government Power: Minting coins helped governments standardize their economies, collect taxes efficiently, and show their authority.

- How Coinage Changed the World:

- Economic Boom: Easier trade led to more buying and selling, causing economies to grow and people to become wealthier.

- Mighty Empires: With strong economies, empires could raise large armies and conquer new lands.

- Spread of Ideas: Coins circulated widely, carrying designs and symbols that spread culture and technology across borders.

Would you like to read more about this innovation? Click this link: coinage

2. Paper Money

- History: Paper money started in China around the 7th century AD. Initially, merchants would deposit their heavy metal coins and get a paper receipt in return. Over time, the government began directly issuing paper money.

- Impact:

- Super Portable: Carrying paper money was much easier than lugging around metal coins, especially for big transactions.

- Government Control: With paper money, governments could more easily influence their economies by increasing or decreasing the money supply.

- Risks Emerge: Issuing too much paper money could cause inflation (prices skyrocketing), and counterfeiters were a constant problem.

- How Paper Money Changed the World:

- Global Trade Growth: Easier long-distance trade transformed the world. Goods flowed more freely between countries.

- Economic Experimentation: Governments began experimenting with ways to manage and stabilize their economies using paper money.

- Shift of Trust: People had to trust the paper itself, not just precious metal, marking a big shift in financial thinking.

Would you like to read more about this innovation? Click this link: THE HISTORY OF PAPER MONEY

Read More: 15 Mind-Blowing Facts About the Global Economy | Unveiled

3. Banking

- History: The basic idea of banking is very old. Ancient temples often safeguarded valuables for people. In Renaissance Italy (14th – 16th centuries), powerful banking families emerged, offering not only safekeeping, but also loans, currency exchange, and financial advice.

- Impact:

- Safe Wealth Storage: Banks offered protected vaults, reducing the risk of theft or loss for businesses and wealthy individuals.

- Credit for Growth: Loans from banks fueled new business ventures and large projects that an individual could never afford alone.

- Economic Engines: Banks became central to commerce, enabling transactions, and managing the flow of money within a society.

- How Banking Changed the World:

- The Rise of the Merchant Class: With access to credit, ambitious individuals could launch businesses and build vast trading networks.

- Industrial Revolution: Banks funded the factories, railways, and inventions that transformed economies from agriculture to industry.

- Complex Financial Systems: Modern banking became interwoven with other financial institutions, creating a vast system that can both power the economy and amplify economic troubles.

Would you like to read more about this innovation? Click this link: The Evolution of Banking Over Time

4. Stock Exchanges

- History: In the 1600s, traders began meeting in coffeehouses and marketplaces to buy and sell shares of companies. This evolved into formal stock exchanges like the London Stock Exchange (founded 1773), with rules and official listings.

- Impact:

- Raising Capital: Stock exchanges made it easier for businesses to raise money by selling shares to the public, fueling their expansion plans.

- Investing for Anyone: While still primarily the domain of the wealthy, stock exchanges made ownership of businesses theoretically accessible to a wider range of people.

- Economic Indicators: Stock prices became a snapshot of how investors felt about individual companies and the health of the economy overall.

- How Stock Exchanges Changed the World:

- Democratized Investing (Sort Of): Though barriers still existed, stock exchanges opened the idea of partial ownership to a wider audience.

- Booms and Busts: Speculation on stock exchanges led to both huge financial gains and devastating crashes as market sentiment swung wildly.

- Capitalism’s Core: Stock exchanges remain a symbol of modern capitalism, with immense power to shape both businesses and national economies.

Would you like to read more about this innovation? Click this link: The Evolution of Stock Exchanges

5. Insurance

- History: The idea of sharing risk has existed for a long time. In ancient times, groups would pool resources to help members who suffered a loss. Modern insurance got serious in the 1600s when merchants began insuring their ships against sinking. Later, life insurance and other types developed.

- Impact:

- Protecting Against Loss: Insurance provides financial compensation when bad things happen – illness, accidents, disasters. This reduces the crushing financial burden of unexpected events.

- Encouraging Risk-Taking: Knowing they’re protected, businesses and individuals are more likely to gamble on new ventures or large purchases.

- Building Security: Insurance creates a safety net, protecting savings and helping families stay afloat during hard times.

- How Insurance Changed the World

- Massive Industry: Insurance is now a global, multi-trillion-dollar industry with companies specializing in countless types of coverage.

- Altered Decision-Making: The existence of insurance changes how we calculate risk, sometimes encouraging bolder choices.

- Essential for Modern Life: From insuring our homes to our health, insurance has become woven into the fabric of society.

Would you like to read more about this innovation? Click this link: History of insurance

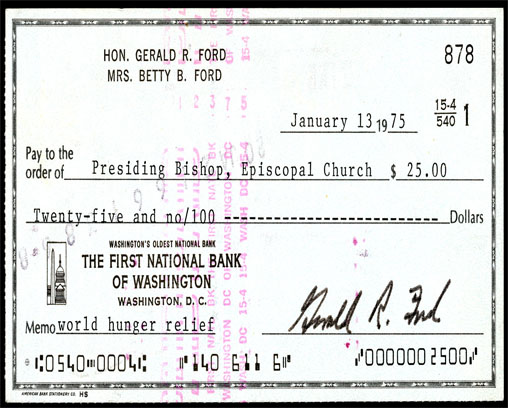

6. Checks

National Museum of American History – Image by Godot13

- History: Checks evolved from “bills of exchange” used by merchants for centuries. By the 1800s, printed checks from trusted banks offered a safer and more standardized way to pay instead of carrying large amounts of cash.

- Impact:

- Secure Payments: Checks offered more protection than carrying cash, especially for long-distance transactions.

- Convenient for Businesses: Businesses could pay suppliers and employees easily and keep better track of their finances than with cash-only systems.

- Reliance on Banks: The check system depended entirely on the trustworthiness of banks to honor and clear the checks as promised.

- How Checks Changed the World

- Streamlined Commerce: Checks made payment systems far more efficient, smoothing trade and day-to-day business operations.

- The Path to Digital Payments: Checks acted as a bridge between the cash era and today’s electronic payments, introducing concepts of authorization and record-keeping.

- Now in Decline: While checks were groundbreaking in their time, they are increasingly replaced by faster, more secure digital alternatives.

Would you like to read more about this innovation? Click this link: brief history of checks

7. Credit Cards

- History: The first modern credit card, the Diners Club card, appeared in 1950. Bank-issued credit cards like Visa and Mastercard followed in the 1950s and 60s. These cards introduced a radical concept – buy now, pay later.

- Impact:

- Spending Power: Credit cards give people access to money they don’t physically have in their pockets, increasing their immediate purchasing power.

- Convenient Payments: A quick swipe (or now a tap) replaces cash or checks, making transactions smoother, especially for larger purchases.

- Fees & Debt Risk: The convenience of credit cards comes at a cost – interest rates and fees, potentially encouraging overspending and debt traps.

- How Credit Cards Changed the World:

- Consumerism Revolution: Credit cards fueled a boom in buying goods and services, becoming an engine of modern consumer culture.

- Altered Personal Finance: How people think about saving vs. spending fundamentally shifted with the availability of easy credit.

- Dependency: Both businesses and individuals now heavily rely on credit cards, making the financial system intricately linked to the credit industry.

Would you like to read more about this innovation? Click this link: History of Credit Cards: A Brief Overview

8. Automated Teller Machines (ATMs)

- History: The first ATM debuted in 1967 in London. But it wasn’t until the 1980s that they became truly widespread, revolutionizing how people interact with their banks.

- Impact:

- 24/7 Banking: No more waiting for bank opening hours! ATMs made it possible to withdraw cash, check balances, and sometimes even make deposits anytime.

- Customer Convenience: ATMs offered a quick and easy alternative to standing in line at a bank branch for simple transactions.

- Expanded Bank Reach: Banks could place ATMs in more locations, extending their services beyond traditional branches.

- How ATMs Changed the World:

- Changed Expectations: The always-on access of ATMs transformed how people think about banking and shaped expectations for immediacy.

- Reduced In-Person Banking: While branches still exist, ATMs shifted many routine transactions away from human tellers.

- Foundation for Further Tech: ATMs were one of the first widespread technologies to personalize banking and opened the door for later innovations.

Would you like to read more about this innovation? Click this link: Automated teller machine

9. Electronic Trading

- History: Stock markets were traditionally bustling places where traders shouted orders on the floor. In the 1970s, computers began to be used, culminating in fully electronic exchanges like NASDAQ replacing the old trading pits.

- Impact:

- Blazing Speed: Electronic trading allows buying and selling stocks in milliseconds, unthinkable in the days of handwritten orders.

- Global Markets: Traders anywhere in the world can access electronic exchanges, creating truly interconnected international markets.

- Rise of Algorithms: Computer programs now execute many trades, driven by complex strategies rather than just human decisions.

- How Electronic Trading Changed the World:

- Market Efficiency (In Theory): Instantaneous trading should make markets more accurately reflect true valuations.

- New Opportunities: High-frequency trading and other strategies became possible, making profits (or losses) on tiny price fluctuations.

- Exacerbated Volatility: Computer errors and automated trading can sometimes cause sudden, dramatic market swings known as “flash crashes.”

Would you like to read more about this innovation? Click this link: A HISTORY OF TRADING

10. Online Banking

- History: Early forms of online banking emerged in the 1980s, but it became mainstream with the rise of the consumer internet in the 1990s. This changed how people manage their money.

- Impact:

- Banking From Anywhere: Access accounts, pay bills, transfer money, and more from the comfort of home (or anywhere with internet).

- Reduced Branch Reliance: Less need to physically visit a bank for most routine financial tasks, saving time and effort.

- Increased Competition: Online-only banks often offer better rates and lower fees compared to traditional institutions with many branches.

- How Online Banking Changed the World:

- Customer Empowerment: People gained more control and visibility over their finances, able to instantly compare options.

- Evolution of Financial Services: Online banking spurred innovation in areas like account aggregation and budgeting tools.

- Accessibility: Banking became more convenient for people in remote areas or those with limited mobility.

Would you like to read more about this innovation? Click this link: A brief history of digital banking

11. Mobile Payments

- History: Early experiments existed, but smartphone capabilities, QR codes, and apps like Apple Pay and Venmo brought mobile payments to the masses in the 2010s.

- Impact:

- Frictionless Transactions: Tap your phone or scan a code to pay instantly – no need for cash or even a physical wallet.

- Peer-to-Peer Revolution: Sending money to friends and family became as easy as sending a text message.

- Financial Inclusion: Mobile payments opened up new opportunities for people without traditional bank accounts.

- How Mobile Payments Changed the World:

- Redefining Convenience: Payments became integrated into our devices, blurring the line between online and offline.

- Cash Decline (in Some Areas): In countries like China, mobile payments have made cash nearly obsolete in certain contexts.

- New Business Models: Mobile payments enable easy micropayments and new ways for businesses to interact with customers.

12. Peer-to-Peer (P2P) Lending

- History: Platforms like LendingClub and Prosper emerged in the mid-2000s, connecting borrowers directly with people willing to lend them money, cutting out traditional banks.

- Impact:

- Access to Credit: Borrowers with less-than-perfect credit scores or unusual needs could find loans outside the banking system.

- Investor Opportunities: Individuals can earn interest by lending, becoming a sort of mini-bank themselves.

- Disruption: P2P lending offered an alternative to banks, increasing competition and potentially lowering rates for some borrowers.

- How P2P Lending Changed the World

- Shifting the Model: Challenged the traditional role of banks as the sole middleman for credit, with promises and risks.

- Democratized Investing (With Caveats): P2P lending opened new investment possibilities but also requires careful research due to the risk of defaults.

- Regulation Evolves: As the industry grew, governments stepped in to create regulations to protect both borrowers and lenders.

Read More: Top 15 Surprising Ways Social Media Impacts the Economy

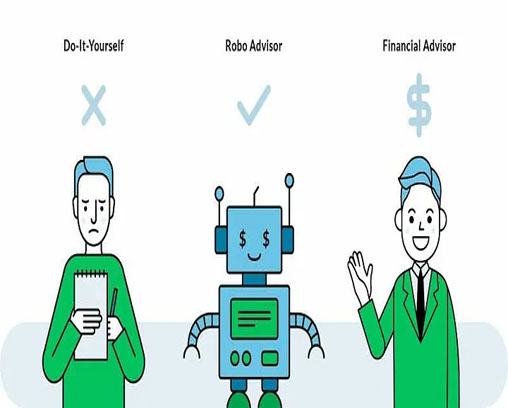

13. Robo-Advisors

- History: Robo-advisors emerged in the late 2000s and gained popularity in the 2010s. These online platforms use algorithms to provide automated investment advice and portfolio management.

- Impact:

- Lower-Cost Investing: Robo-advisors offer far cheaper fees than traditional financial advisors, making professional advice accessible to more people.

- Simple & Convenient: Answer a few questions, and the algorithms build a portfolio for you, making investing less intimidating for beginners.

- Remove Human Element: While some platforms offer limited human support, robo-advisors largely eliminate personal advisor relationships.

- How Robo-Advisors Changed the World

- Democratized Investment: They opened up investing to a broader audience who previously couldn’t afford or didn’t want human advisors.

- Passive Investing Focus: Robo-advisors often favor low-cost index funds, promoting the advantages of long-term passive investment strategies.

- Debate Continues: Critics argue that algorithms can’t replace the nuanced advice a human advisor offers, especially for complex situations.

Would you like to read more about this innovation? Click this link: What Is a Robo-Advisor?

14. Crowdfunding

- History: Platforms like Kickstarter and Indiegogo emerged in the early 2000s, allowing people to pitch projects directly to the public for funding. This revolutionized how ideas get off the ground.

- Impact:

- Creator Empowerment: Individuals and small businesses can bypass traditional gatekeepers (investors, publishers) and find their own audience.

- Funding Innovation: Many quirky, niche, or risky projects that would never get traditional funding found a lifeline on crowdfunding platforms.

- Community Building: Successful campaigns become mini-communities of supporters, building excitement long before the product exists.

- How Crowdfunding Changed the World

- New Business Models: Creators now have more ways to finance ideas, leading to a boom in entrepreneurship.

- Pre-Ordering Evolution: Crowdfunding is a form of pre-ordering, changing our expectations about how products get made.

- Success Not Guaranteed: Many crowdfunded projects fail to deliver, highlighting the risk for supporters compared to established businesses.

Would you like to read more about this innovation? Click this link: The History of Crowdfunding

15. Cryptocurrency

- History: Bitcoin, the first and most famous cryptocurrency, launched in 2009. It utilizes blockchain technology – a decentralized, secure, digital ledger that verifies transactions.

- Impact:

- Decentralized Currency: Crypto aims to bypass banks and governments, offering currency uncontrolled by any central authority.

- Volatile Investments: Cryptocurrencies are known for wild price swings, making them high-risk investments attracting speculators.

- Potential Disruption: If widely adopted, cryptocurrencies could upend traditional financial systems, but this is far from guaranteed.

- How Cryptocurrency Changed the World

- Alternative Finance: Crypto ignited a movement towards decentralized finance with experimental lending, payments, and trading systems.

- Focus on Blockchain: The underlying blockchain technology has potential uses far beyond currency, with applications in record-keeping and contracts.

- Ongoing Debate: Crypto remains highly polarizing – seen as a revolutionary future of money by some, and a dangerous bubble by others.

Would you like to read more about this innovation? Click this link: The History of Bitcoin, the First Cryptocurrency

Conclusion

Throughout history, financial innovations have reshaped the way we interact with money. From coinage to cryptocurrency, these advancements have streamlined trade, fueled growth, empowered individuals, and created complex economic systems. Understanding how these innovations transformed the world gives us valuable insight into the future of finance, a future marked by ongoing technological breakthroughs and changing relationships with money.

15 FAQs about financial innovations

-

What are the most significant financial innovations in recent history?

In recent decades, online banking, mobile payments, peer-to-peer lending, robo-advisors, and cryptocurrencies have significantly impacted how we manage, invest, and transact.

-

How do financial innovations benefit society?

They can increase financial inclusion, make transactions more efficient, provide new investment opportunities, promote entrepreneurship, and spur economic development on various levels.

-

Are there any downsides to financial innovations?

Innovations can create market volatility, enable scams, amplify economic inequality if access is limited, and introduce systemic risks due to the interconnectedness of financial systems.

-

What factors drive financial innovation?

Technological progress, changing consumer needs, shifting economic climates, regulatory environments, and the desire for increased efficiency and profit all drive innovation in finance.

-

How can I protect myself when using new financial innovations?

Research thoroughly, prioritize reputable platforms, understand the risks, diversify your assets, and maintain strong cybersecurity practices.

-

What is the difference between cryptocurrency and traditional money?

Traditional money (like US dollars) is issued and controlled by governments. Cryptocurrency is decentralized, meaning no single authority controls it. Crypto exists only digitally, while traditional money also has physical forms like cash.

-

Is investing in cryptocurrency a good idea?

Cryptocurrency is incredibly risky. Prices can swing wildly up or down in a short time. It’s only suitable for some people with a high-risk tolerance and might be more like gambling than traditional investing.

-

How do I get started with online banking?

If you have a bank account, they likely offer online banking. Visit their website or ask at the branch to set up your login. Online banking lets you do the same things as in-person but from your computer or phone!

-

Are mobile payments safe?

Reputable mobile payment apps are quite secure. They use encryption to protect your data. It’s still safer than carrying cash, which can be easily stolen.

-

What is the purpose of a stock exchange?

Stock exchanges are like marketplaces where people buy and sell tiny pieces of ownership in companies (shares of stock). This helps businesses raise money and lets investors potentially make profits if the company does well.

-

How does insurance work?

You pay a regular fee (a premium) to the insurance company. In exchange, they promise to cover the cost (or part of it) if something bad happens – like a car accident or illness. It’s a way to protect yourself from huge unexpected expenses.

-

What makes a good credit score?

A good credit score shows you’re reliable with money. This means: paying bills on time, not having too much debt, and having a long history of using credit responsibly. A good score can get you better loan rates.

-

Is crowdfunding a reliable way to fundraise?

Crowdfunding can be successful, but it’s not guaranteed. You need a good project idea, a compelling pitch, and a way to reach your target audience. Even successful campaigns might raise less than you need.

-

What’s the difference between a bank and a credit union?

Both offer similar services (accounts, loans). Credit unions are owned by their members (customers), often have lower fees, but might have less branch locations. Banks are for-profit companies.

-

Where can I learn more about financial innovations?

Financial news websites, podcasts explaining finance for beginners, and even your bank’s website can be good resources. Look for information written in a way you can understand!